Digital Tranformation BFSI | Accelerating Banking Digital Transformation | Tapams

Context and Changing Business Climate

Digital has transformed BFSI organizations completely and today IT is not limited to just providing online and mobile functionality but revolutionized spectrum of services they offer to customers but have changed the way business run and operate in an highly regulated environment.

Organizations today can effectively plan, enable and deliver value from their digital business journeys. Technology delineates the future of the relationship of customers and banks. IT plays a larger role — in creating new possibilities and capabilities that will lead business strategies and operations into the future.

Digital Transformation in BFSI

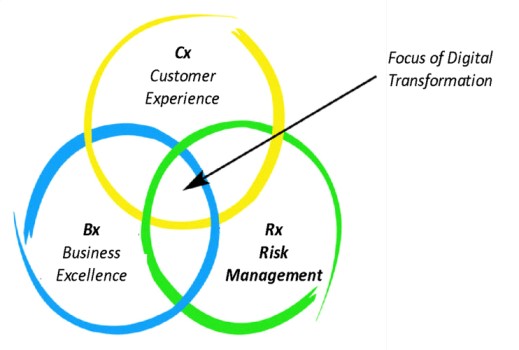

Digital Transformation embeds digital into value stream of business and services. A perfect digital strategy is a critical imperative for a success of the Banks and Financial Organizations of future. The increasing adoption of smart devices with phenomenal computing power for customers alongside with evolution of technologies like Robotics, Artificial Intelligence, IoT, Cloud Computing, Blockchain & Cryptos , Biometrics, Big Data and Analytics, Virtual Reality /Augmented Reality and Mixed Reality for businesses the possibilities for transforming relationships into new revenue streams for competitive advantage , optimize cost and superior customer experience.

Imperatives of banks and organizations in future

| Customer Experience | Business Excellence | Risk Management |

|---|---|---|

| Hyper Personalization delivers message to a "segment of one Individualized experiences and relevance and speed in delivering the desired product and Service | Intelligent and autonomous processes augmented with exception handling though technology | Proactive Management of Credit, operational and Market Risks |

| Digital Experience with human touch interactions making the experience more personalized and contextualized | Application of transformation levers across all the aspects of processes with a CSI culture embedded into the system | Adhere and demonstrate compliance and control of the evolving Regulatory Requirements |

| Transparency. Security. and Trust on the ways their money and data are used | Real-time optimization of operating and engagement models for enhance On investment through Transformation Analytics | innovation and Proactive controls improving resilience detection and recovery of the services with minimal or no impact to customers banks and community |

Digital transformation is not monochromatic but is a collective representation of business model (strategy), business process, technology, Innovation and culture. Hence its imperative that the approach towards digital transformation is also a comprehensive and holistic

Our Approach

Objective of any digital transformation initiative is to deliver superior business and end user experience through a flexible, responsive and forward looking service that supports current and evolving business needs at an optimal cost.

- Personalized Customer Experienced

- Seamless omni channel experience

- Ensure highest level of assurance on data and their money

- Demonstrating leadership, collaboration and accountability to successfully support business

- Targeted Future of Work adoption

- Differentiated Classes of service - "Fit for Purpose"

- Improved performance through self help/self heal initiative

- Continuous Service improvements and Deployment of team techniques

- Use of technology basis fit for purpose, rather than board scale "carpet bombing" implementations

- Move from thick clients from thin clients, keeping interfaces light and User Experience stays at the Edge

- Benchmark and comparison against industry standards and adaption trends

- Align existing assets to make them "fit for purpose" and deliver value

- Pro-active mobilization of technology

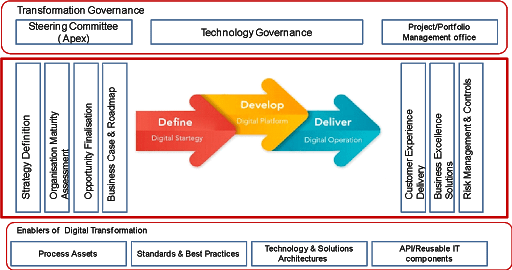

3D Approach (Define – Develop –Deliver)

Examples of Digital Transformation Journeys

- Customer Onboarding

-

- Account Opening

- KYC Management

-

- Customer Account Servicing

-

- BAU Operations Management ( Customer Information Updates)

- Service Fulfillment (Non financial Transactions –Ex Balance Enquiry, Letters and Issuance of Certificates)

- Payments and Fund Transfer transactions

-

- Compliance & Regulatory

-

- Audit and Compliance

- Mandatory Trainings and Disclosures Management

- Ongoing and Regulatory Controls Management

- Daily/Weekly/Monthly/ concurrent review management

-

- New Business Products & Services

-

- Customized and fast product launches

- New and Personalized Service Definition

-

In Summary, Digital Transformation in Banks is far beyond just moving from traditional banking to a digital world. It is a breakthrough change as how banks and other financial institutions interact with various stakeholders to enable solutions. Successful Digital Transformation begins with an understanding of customer and business priorities and balancing them to implement changes that enable the organizations to leaps and bounds of prosperity and success with unwavering customer satisfaction